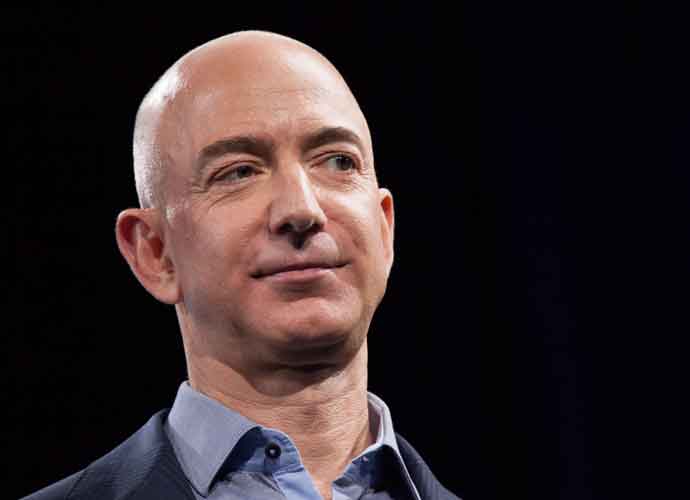

Amazon.com founder and CEO Jeff Bezos (Image: Getty)

The richest Americans pay a minute fraction of their income in taxes based on income, according to a new report from ProPublica.

The United States has a theoretically progressive federal tax code, consisting of seven federal income tax brackets with rates ranging from ten percent to 37% depending on reported income. A source leaked a mass of Internal Revenue Service documents that show, in 2018, the 25 richest Americans paid 13.3% of their reported incomes in taxes – when they should have been paying a few points shy of 40% based on the tax code.

To put it in perspective, a typical worker in America who makes a yearly salary of $45,000 would have paid about $10,700 in taxes in 2018 – nearly 20%. Compare that to those who make more than half a billion dollars a year and pay 13% in taxes.

The leaked data files included tax and income information for some of the nation’s richest people. Warren Buffet, Bill Gates, Jeff Bezos, Mark Zuckerberg and many more modern-day tycoons were named in the report. Bezos, the founder of Amazon, did not pay an income tax in 2007 and 2011. Elon Musk, founder of Tesla, did not pay an income tax in 2018.

Subscribe to our free weekly newsletter!

A week of political news in your in-box.

We find the news you need to know, so you don't have to.

These two billionaires, among many other billionaires and millionaires, are able to evade paying federal taxes through a variety of generally legal loopholes in the system – avoiding wage taxes and, instead, paying taxes on investments.

This issue only drives the increasing wealth gap in the U.S. Sen. Elizabeth Warren (D-Massachusetts) has proposed a tax on the accumulated wealth of Americans rather than just a tax on yearly income, which many rich individuals are able to find ways out of paying. Warren believes it is the only way to get the wealthiest to pay their “fair share” of taxes.

In order to have the funds for his spending plans, which are focused on education and infrastructure, President Joe Biden is looking to increase the tax rate for the higher income brackets up to 39.6%. Only about 2% of households in America fall into this bracket. Further, the president has suggested doubling the tax rate on high profits that come from investments.

The Group of Seven wealth democracies is already taking steps to limit the offshore stashing of wealth and fighting tax evasion.

President Donald Trump has nominated a former right-wing podcaster to lead a federal watchdog agency.…

The Trump Organization, President Donald Trump’s holding company for his investments and business ventures, has…

Democratic lawmakers have criticized President Donald Trump for issuing a precision strike on Iranian nuclear…

Following the Sunday strikes on three of Iran's nuclear facilities by the U.S., world leaders…

On Sunday, the U.S. military bombed Iran's Fordo, Natanz and Isfahan nuclear facilities. Pentagon officials…

Florida Gov. Ron DeSantis said Floridians have the right to drive into crowds of protestors…