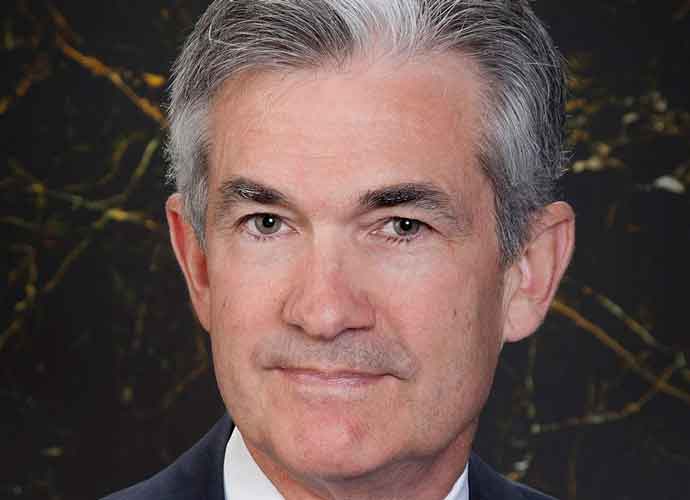

FED Chairman Jerome Powell (Image: Getty)

The Federal Reserve announced on Sunday that it would be cutting interest rates back to zero and that it would buy billions of dollars in bonds in an effort to protect the economy from the shock the coronavirus has had on the economy.

The Fed said they would keep the interest rates at zero “until it is confident that the economy has weathered recent events.” The decision comes as the stock market falls more and more each day. The Dow alone has plunged 9%.

President Donald Trump praised the Fed for their decision. “It makes me very happy, and I want to congratulate the Federal Reserve,” he told reporters on Sunday. “That’s really good news, that’s really great for our country. … I think people in the market should be very thrilled.”

The emergency response was one of the federal government’s first actions in helping the economy stay afloat during the coronavirus outbreak. The House passed an aid package of bills of workers on Saturday and is set to be reviewed by the Senate soon.

Subscribe to our free weekly newsletter!

A week of political news in your in-box.

We find the news you need to know, so you don't have to.

The Fed said it would increase its holdings of government bonds by at least $500 billion and its holdings on mortgage-back securities by at least $200 billion. This is very similar to actions taken in the 2008 financial crisis.

Federal Reserve Chair Jerome Powell told reporters that the purchases made are aimed at making sure essential U.S. markets are properly functioning. According to Powell, the bond market, “plays an important role in allowing households and firms to earn a safe return and manage their risks.” He added, “When stresses arise in the Treasury market, they can reverberate through the entire financial system and the economy.”

CHECK CURRENT DEMOCRATIC PRIMARY DELEGATE TOTALS HERE!

Powell also acknowledged the effect that the virus has already caused. “The cost of credit has risen for all but the strongest borrowers, and stock markets around the world are down sharply,” he said.

Sen. John Fetterman (D-Pennsylvania) has had more top staff departures. Last week, Fetterman’s chief of…

Attorney General Pam Bondi has taken her criticism of Los Angeles protesters to the next…

The Trump Administration has a new plan to change the process of detaining and deporting…

Following President Donald Trump’s “Liberation Day” tariff announcement in April, members of Congress were unusually…

President Donald Trump’s approval rating has fallen to 38 percent, the lowest mark of his…

https://www.youtube.com/shorts/-5miskGO5lo California Senator Alex Padilla was forcibly removed from a press conference held by the…