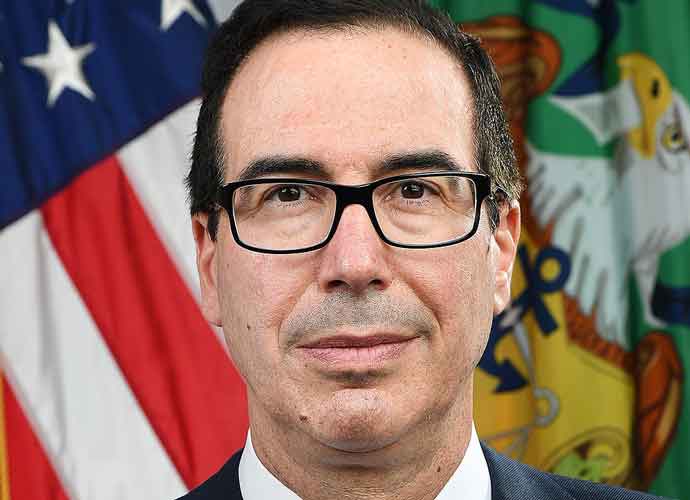

Treasury Secretary Steve Mnuchin

The Internal Revenue Service is now requesting the return of more than one million stimulus checks that were sent to deceased people, in a sudden reversal.

The IRS knew some checks were being sent to people who had filed taxes but passed away, however initially believed it did not have the authority to withhold them.

The Government Accountability Office said in an analysis released Thursday said that as of April 30, almost 1.1 million payments totaling $1.4 billion had been sent to the dead.

Rep. Thomas Massie (R-Kentucky) tweeted an example of one such mispayment, where his friend’s recently deceased father received a $1200 stimulus check in the mail.

Subscribe to our free weekly newsletter!

A week of political news in your in-box.

We find the news you need to know, so you don't have to.

The report did not disclose when the decision to block payments to the deceased was made, nor did it say who made that call.

Initially, it was believed that any overpayment made by the IRS will not have to be returned, because it is considered a “clerical or math error on behalf of the IRS.”

According to the report, the IRS noticed the potential problem in late March, while Congress was still creating legislation to authorize the checks.

“IRS counsel subsequently determined that IRS did not have the legal authority to deny payments to those who filed a return in 2019, even if they were deceased at the time of payment,” GAO said.

About a month later in mid-April, President Donald Trump said publicly he wanted any checks sent to the dead returned.

On May 6, the IRS echoed Trump’s statement, including directions on how to return the money on the envelopes containing the payment. The decision to stop the checks was made under a 2019 law targeting improper payments, prompting the IRS to begin cross-referencing stimulus payments with death records.

“IRS does not currently plan to take additional steps to notify ineligible recipients on how to return the payments,” GAO said. “IRS should consider cost effective options for notifying recipients on how to return the payments; without which, ineligible recipients who would otherwise want to return the payment may be unaware how to do so.”

British Prime Minister Keir Starmer announced Tuesday that the United Kingdom will recognize Palestine as…

Former North Carolina Gov. Roy Cooper (D) announced he will run for North Carolina’s open…

President Donald Trump is losing support from independent voters, fueled by disappointment with the handling…

Rep. Marjorie Taylor Greene (R-Georgia) dubbed the humanitarian conflict in Gaza a “genocide” in a…

Rep. Thomas Massie (R-Kentucky) and Rep. Ro Khanna (D-California) are leading a bipartisan push to…

The Trump Administration is working with tech company Palantir to collect all unclassified information about…