Paycheck Protection Loan Program For Small Businesses Roll Out Falters As Banks Seek Clarity

Banks have been delaying their Paycheck Protection Program Loan programs, which were a major feature of the coronavirus economic relief package that passed last Friday designed to support small businesses.

The $349 billion program provides businesses with less than 500 employees up to $10 million in low-interest loans. Small businesses, self-employed, freelancers and gig workers are all eligible to apply. The loans featured no collateral, deferral of payments for six months and partial forgiveness if the money was spent on certain operating costs within the first eight weeks.

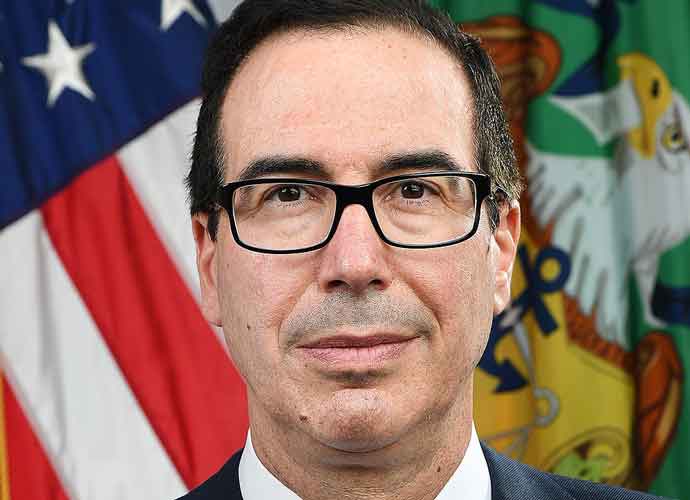

Treasury Secretary Steven Mnuchin said Tuesday that the “Treasury and the Small Business Administration expect to have this program up and running by April 3rd so that businesses can go to a participating SBA 7(a) lender, bank or credit union, apply for a loan and be approved on the same day,” effectively giving banks four days to set up their programs.

Some institutions, like Chase Banks and Fifth Third Bank, delayed the launch of their loan program until they had all “the necessary information that our customers need to provide in addition to what the bank needs to process these specific loan applications.”

Subscribe to our free weekly newsletter!

A week of political news in your in-box.

We find the news you need to know, so you don't have to.

CORONAVIRUS FAQ: WIKI OF MOST FREQUENTLY ASKED QUESTIONS

Fifth Third explained their decision to postpone launching the loan program in an email to clients.

“It’s critically important to us at Fifth Third Bank FITB, that we do not roll out a platform whereby the borrower completes the application only to either have to re-apply later and/or that application sits in a stagnant queue due to the lack of process guidance from the SBA for this particular program,” the email reads. “We feel it would be inappropriate to launch without the necessary information that our customers need to provide in addition to what the bank needs to process these specific loan applications.”

Fifth Third also noted that “there have also been revisions by the SBA (as recently as this afternoon) to the original program that was communicated to the country.” For example, the Trump administration had set the loan interest rate at 0.5% on Tuesday, but raised it to 1% on Thursday.

Their email also mentioned that many other banks are delaying their programs “due to the same reasons,” but assured customers that “America’s largest banking institutions will have full and appropriate access to these funds.”

Other banks required customers seeking loans to be preexisting clients, a stipulation not outlined in the bill.

Bank of America opened its online portal Friday but required applicants to have a “pre-existing business lending and business deposit relationship with Bank of America, as of February 15, 2020.”

JPMorganChase had said they were waiting on additional information and “most likely wouldn’t be able to start accepting applications,” but opened their application portal on Friday as well. However, applicants must submit their contact information and wait for a representative from the bank to contact them, further delaying the process. And like Bank of America, only those who had a Business Checking account prior to Feb. 15 may apply.

It is unclear when loans payments will begin, but those with questions about the application process should reach out to their individual banking institution.

Get the most-revealing celebrity conversations with the uInterview podcast!

Leave a comment