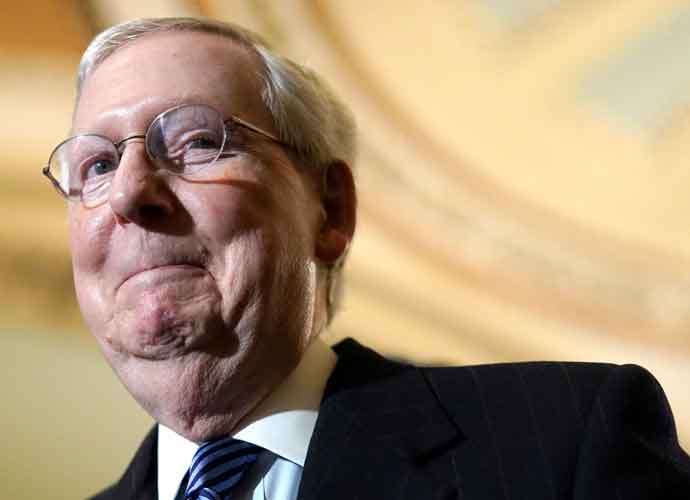

WASHINGTON, DC - DECEMBER 03: Senate Majority Leader Mitch McConnell (R-KY) answers questions during a press conference following a weekly policy lunch at the U.S. Capitol on December 03, 2019 in Washington, DC. (Photo: Getty)

The December 15 deadline set by United States Treasury Secretary Janet Yellen for lawmakers on Capitol Hill to extend the federal government’s borrowing limit – and avoid a catastrophic default on the national debt – is fast approaching. But leaders inside both political parties are mired in slogging negotiations with little to show for it.

“We agree to kind of keep talking, working together to try to get somewhere,” Senate Minority Leader Mitch McConnell (R-Kentucky) said on November 18 following a meeting he held with Majority Leader Chuck Schumer (D-New York).

Congress last raised the debt ceiling, which has become a legislative hot potato in the 21st Century, in October. Now, just like then, how this gets accomplished is the crux of the stalemate. Republicans insist that Democrats, who hold a one-seat voting majority in the Senate due to Vice President Kamala Harris‘s role breaking a tie, should use the reconciliation process to fast-track an extension of the debt limit.

While that would indeed save time and eliminate the need for 60 votes to advance a bill, it comes with some major caveats, not the least of which is that a reconciliation proposal requires amending the budget with updated rules, which can take weeks that Congress no longer has at its disposal.

Subscribe to our free weekly newsletter!

A week of political news in your in-box.

We find the news you need to know, so you don't have to.

Democrats could also overrule the Senate parliamentarian’s declaration that the debt ceiling cannot be tweaked as a stand-alone policy.

Another option would be for Republicans to sign on to a short-term extension in exchange for Democrats agreeing to consider spending reforms (in other words, cuts to programs such as social services and entitlements). But this would only kick the can further down the road until the next crisis.

Whether a deal is reached or not will have varying effects on the domestic and global economy. A debt default would have devastating impacts on global economic output and would seriously if not irreparably weaken the dollar. History has also shown that even the prospect of a default, no matter how remote, can throw markets into a frenzy and hamper economic growth. In terms of avoiding chaos, the sooner an agreement emerges, the better.

President Donald Trump publicly clashed with Attorney General Pam Bondi on Saturday in a Truth…

At the Sunday memorial service for political commentator Charlie Kirk, President Donald Trump aimed at…

U.S. District Judge Steven Merryday, a federal judge from Florida, threw out President Donald Trump's…

The Trump administration has ordered several national park sites to remove signs and exhibits related…

After announcing the state's plan to eliminate all vaccine mandates earlier this month, Florida Surgeon…

Amidst calls for the "dissolution of parliament" and a "change of government," while virtually participating…